Table of Contents

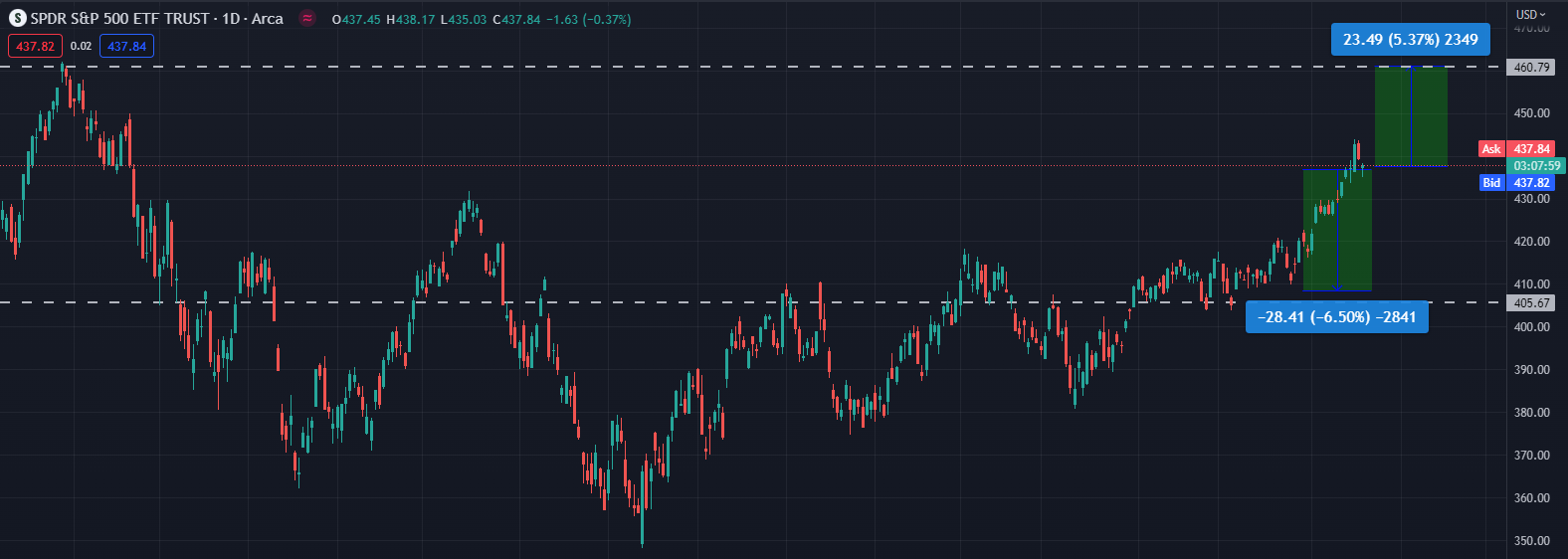

- SPDR SPY ETF forms a bullish pattern as the fear and greed index rises

- SPY ETF: Strategy To Protect Against Surprises During Market (NYSEARCA ...

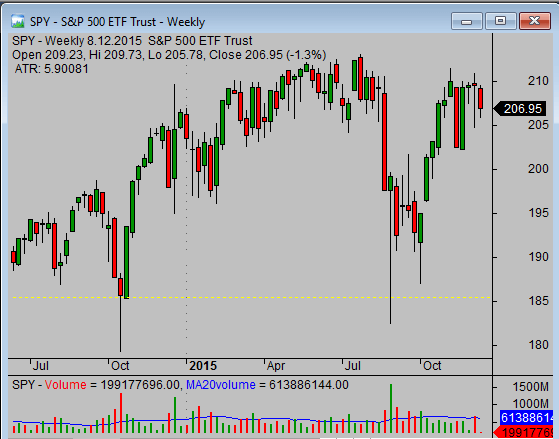

- S&P 500 ETF SPY chart updated - chartprofit.com

- SPY ETF 구성 종목 및 소개(S&P500 지수 추종)

- What are ETF shares - Simple stock trading

- Why Some Stock Traders Get Rich and Some Stay Poor

- What Exchange Does The Spy Etf Trade On App For Windows

- SPY ETF Explained

- SPY ETF: Momentum Is In The Cards (NYSEARCA:SPY) | Seeking Alpha

- New SPY ETF Prediction | Stock Market Feels Heavy | DDOG Trade Setup 6 ...

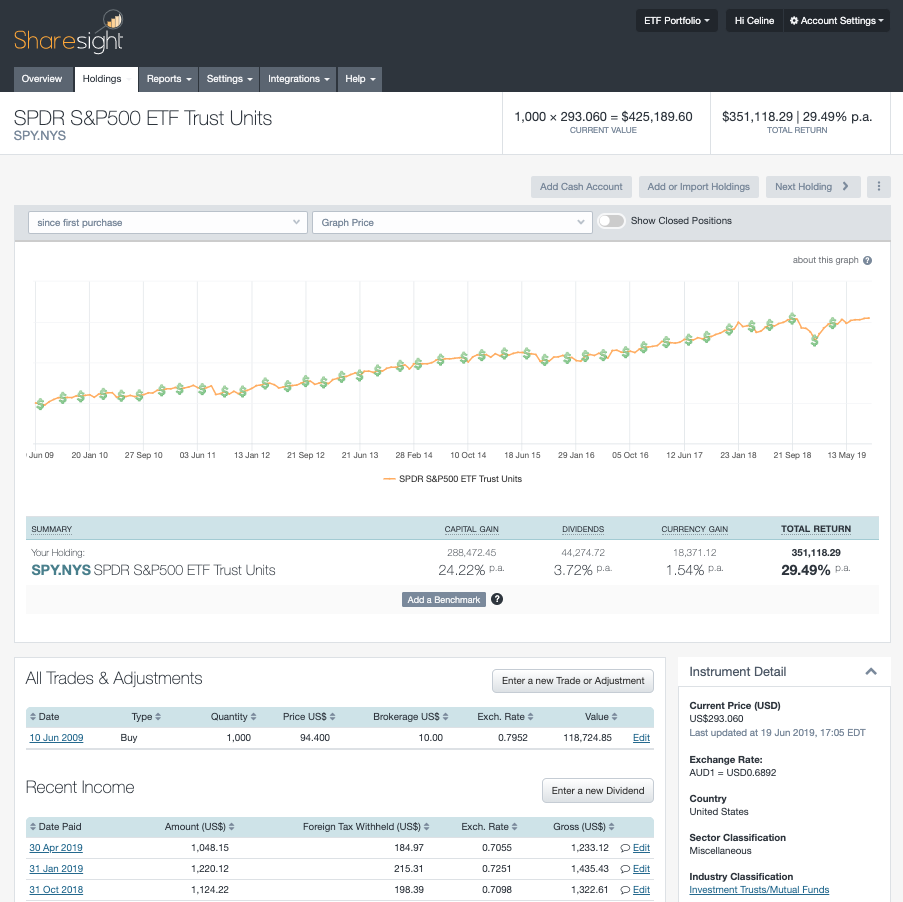

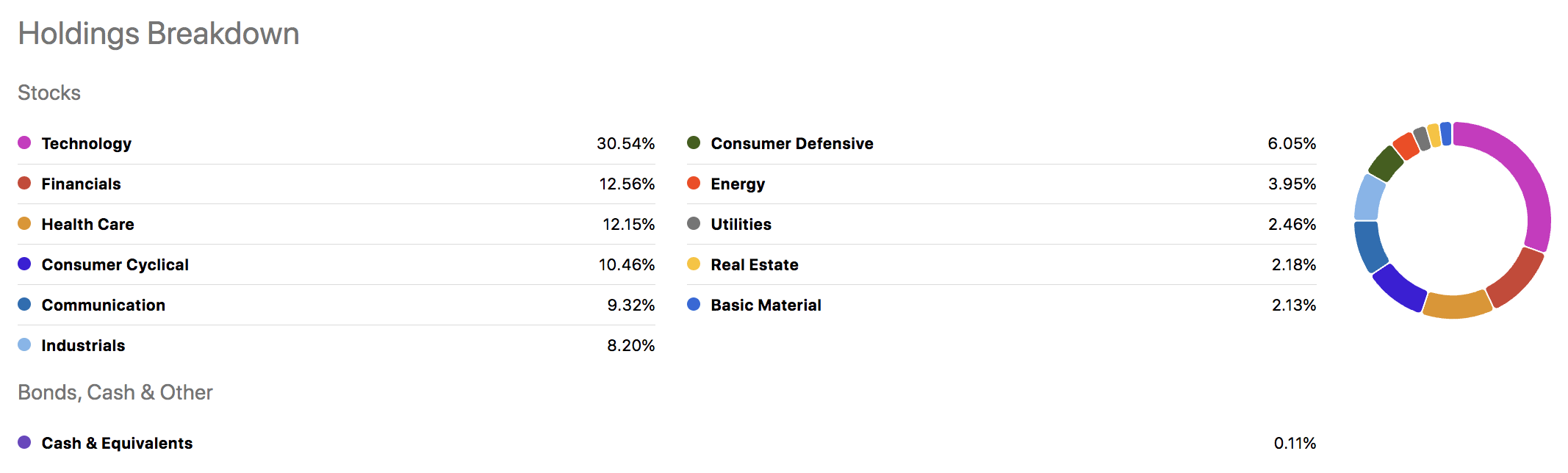

What is the SPDR S&P 500 ETF Trust?

Benefits of Investing in the SPDR S&P 500 ETF Trust

How to Invest in the SPDR S&P 500 ETF Trust

Investing in the SPDR S&P 500 ETF Trust is relatively straightforward. You can buy shares of the SPY through a brokerage account, such as Fidelity, Charles Schwab, or Vanguard. You can also invest in the SPY through a financial advisor or investment manager. It's always a good idea to consult with a financial professional before making any investment decisions. The SPDR S&P 500 ETF Trust is a popular and widely traded ETF that provides investors with a convenient and cost-effective way to gain exposure to the US stock market. With its low costs, diversification benefits, and convenience, the SPY is a valuable addition to any investment portfolio. Whether you're a seasoned investor or just starting out, the SPY is definitely worth considering.For more information on the SPDR S&P 500 ETF Trust, including its current price, holdings, and performance, visit the SPDR S&P 500 ETF Trust website. You can also visit the ETF Database website for more information on ETFs and how to invest in them.

Investing in the stock market involves risks, and there are no guarantees of returns. However, with the SPDR S&P 500 ETF Trust, you can gain exposure to the US stock market with a diversified portfolio of stocks, making it a great option for investors looking to build long-term wealth.

Note: The content provided is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial professional before making any investment decisions.